Economic Policy

Biden’s economic plan will energize growth and help build a fairer economy that works better for everyone.

Joe Biden has broadly dubbed his economic reform policy “Build Back Better”, which outlines concrete policies that will help restore a thriving American middle class and rebuild a strong & equitable American economy. The coronavirus pandemic has laid bare something we already knew to be true - the middle class in America is faltering - severely. Most families are one or two missed paychecks away from financial disaster. Biden knows how vital the working and middle class are to the American story, while also acknowledging that we must begin to transition to a carbon-neutral economy. His policies strategically lay out plans to bolster the middle class by retooling our skills training programs and industries in a way that is sustainable not only for job security, but for our planet.

Joe Biden’s economic policies focus on strategic federal spending that will help build a stronger American economy, while reducing the federal deficit. A study by the University of Pennsylvania’s Wharton School of Business found that the targeted spending in Biden’s economic policies would increase federal debt by .1% in 2030, but then decrease the federal debt by 1.9% in 2040, and 6.1% by 2050.

This means that Biden’s strategic government spending will actually help to decrease the federal deficit because he will make smart and sound investments that will pay off in the long run.

This includes investing in American infrastructure, transitioning the economy to clean energy, and investing more federal dollars in research and development. Summarizing this new analysis from Wharton, a recent CBS News article reported,

☞

☟

“Joe Biden’s economic proposals would create a faster growing economy, higher wages for American workers and reduce the debt compared to where the U.S. is headed under President Donald Trump.”

CURRENT STATE OF THE U.S. ECONOMY

To understand Joe Biden and Kamala Harris’ plans for the American economy, we first have to understand the major trends that are occurring in the American economy (and to remember that the economy and Wall Street are different!). America is supposed to be a country of equal + ample economic opportunities, but it has become a country of economic inequality that works for the rich and leaves the middle and working classes behind.

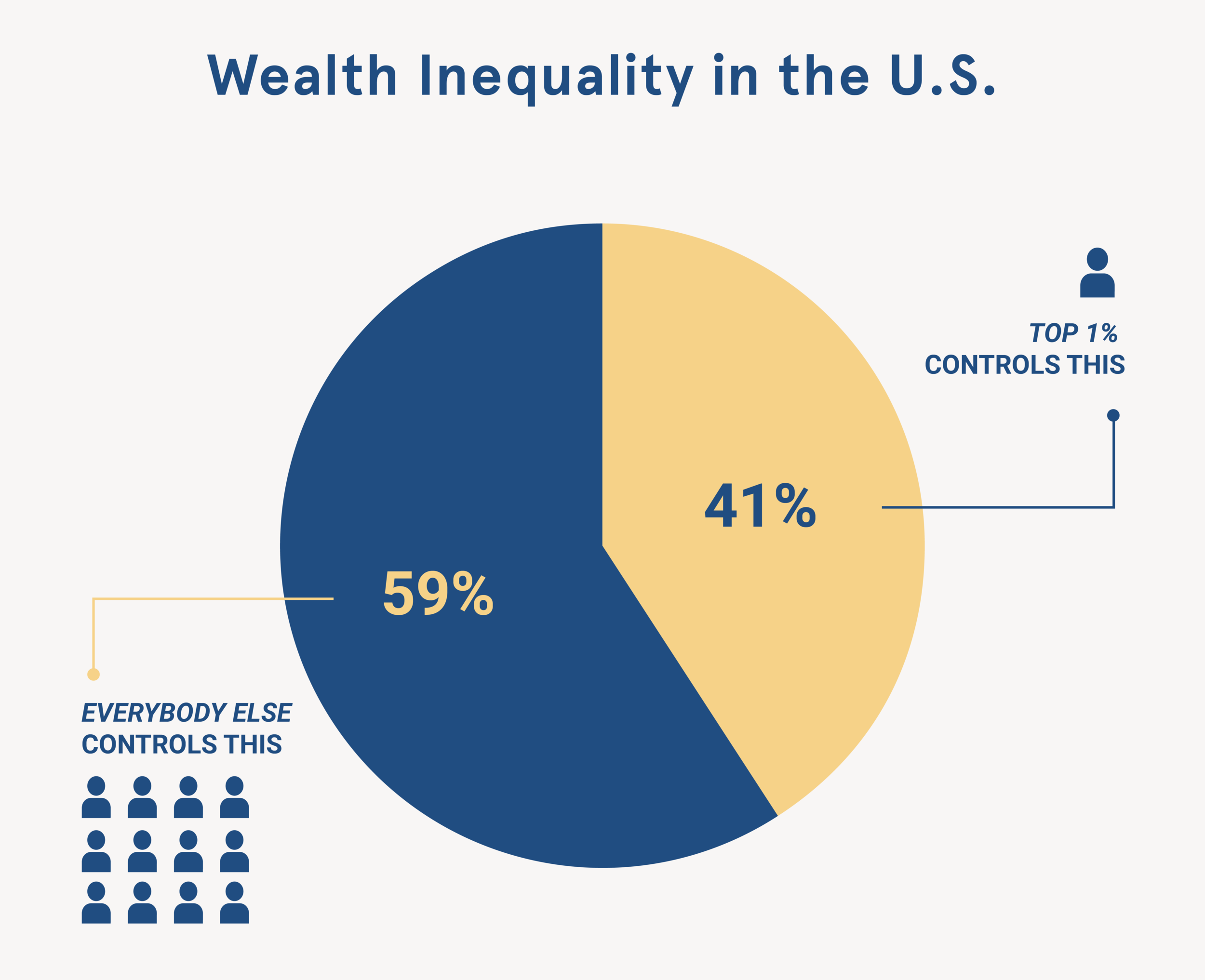

Source: Zucman, G. (2016). State of the Union: Wealth Inequality. Palo Alto, CA: The Stanford Center on Poverty and Inequality. Retrieved from https://inequality.stanford.edu/sites/default/files/Pathways-SOTU-2016-Wealth-Inequality-3.pdf

Concentrated Wealth

Wealth inequality has dramatically increased since the 1980s in the United States. A 2016 article by the Federal Reserve Bank of St. Louis found that the top 10% of the Americans have about 77% of the household wealth, which is a 10% increase from 1989.

→ Wealth concentration is the share of America’s total household wealth that is held by the nation’s wealthiest. In the United States, the top .01% now controls about 21% of household wealth and the top 1% now controls about 41% of household wealth (Zucman).

The Tax Cuts and Jobs Act of 2017 (TCJA) accelerated this wealth concentration by rewriting the tax code to benefit the already rich by reducing the tax rate from 39.6% to 37% for the highest income bracket. The Tax Cuts and Jobs Act also reduced taxes on long-term capital gains, which are profits made on investments held for longer than a year. Low long-term capital gains taxes disproportionately benefit wealthy Americans with many long-term assets such as property, stocks, bonds, and inheritance. These tax cuts accelerate wealth inequality.

While tax reforms included in the Tax Cuts and Jobs Act were touted as a tax cut for the middle class, the Tax Policy Center at the Brookings Institute found that those in the lowest income bracket will see a tax decrease of .4%, those in the middle tax brackets will see a tax decrease of 1.3% and those in the highest brackets will see a decrease of 2.3%.

A report by the Tax Policy Center that analyzed the tax reforms included in the Tax Cuts and Jobs Act and found that “highest income households would generally receive the largest percentage boosts in after-tax income” and “a significant majority of low-and middle-income households will eventually end up worse off.”

Recent Corporate Tax Changes

The Tax Cuts and Jobs Act of 2017 (TCJA) made significant changes to the corporate tax code. According to an article posted on POLICYed written by Hoover Institute fellows, “the Tax Cut and Jobs Act of 2017 included the largest change to the corporate tax code since 1986. The reforms reduced the top corporate tax rate from 35 percent down to 21 percent. Congress’s economists expect the rate cut would reduce corporate income tax revenue [collected by the Federal government] by more than $1.3 trillion during the next ten years.”

So, what are companies doing with these tax savings? Instead of making capital investments in their businesses, creating new jobs or paying their employees higher wages, a report from the Roosevelt Institute found that most companies are using their tax savings from the corporate tax rate cut to buy back their stocks.

The Harvard Business Review reports that “in 2018 alone, with corporate profits bolstered by the Tax Cuts and Jobs Act of 2017, companies in the S&P 500 Index did a combined $806 billion in buybacks." High levels of corporate stock buybacks make “both wealth and income inequality worse…because the gains…are concentrated among the already-wealthy”. Stock buybacks also reduce liquidity of corporate cash, meaning fewer employees see wage growth (Palladino).

Economists believe that American companies’ economic investments spurred by tax savings have been underwhelming at best, and probably do not justify the Federal government’s huge tax revenue loss (between $1.3 - $1.5 trillion over the next ten years) that is a result of slashing the corporate tax to 21 percent. This revenue loss increases the Federal deficit each year.

Wage Stagnation & Income Inequality

In the past few decades, wage growth for middle and low-income workers has been sluggish. The federal minimum wage has been $7.25 since 2009 and has since lost 9.6% of its purchasing power to inflation.

A study from the Economic Policy Institute (EPI) shows that from 1948 to 1973, the hourly wage grew 91% while productivity grew 97%. Compare this to between 1973 and 2013, when productivity increased 74% but hourly wages only grew 9%.

Source: Mishel, L., Gould, E., & Bivens, J. (2015). Wage Stagnation in Nine Charts. Economics Policy Institute. Retrieved from https://www.epi.org/publication/charting-wage-stagnation/

It’s clear that Americans are producing far more work than they are being compensated for in their paychecks. So, who is benefiting from this increased productivity? The same EPI report breaks down and compares the annual pay increases from 1979 to 2013 among the top 1% and the bottom 90%. The top 1% saw a 138% increase in real annual wages compared to a 15% increase in real annual wages for the bottom 90%. Currently, most CEOs make approximately 296 times more than their company’s average employee, compared to 22 times more in 1973. Joe Biden’s economic plans seek to address these stark income inequalities and he is committed to fighting for a living wage for all American workers.

FINANCIAL SECURITY FOR ALL AMERICANS

Investments in Public Education

Biden knows that to build a strong economy that can compete in our globalized world, American workers need to be equipped with the right skills and education to help them succeed. Biden believes that Americans need advanced skills and training to stay competitive in the today’s job market, so he is proposing to increase education spending by $1.9 trillion over 10 years. Some of this spending will go towards investing in community colleges – Biden’s plan proposes 2 years of free community college for American adults (including Dreamers) who never had the chance to go to college and for those who want to go part-time.

Biden has also proposed making tuition for public universities free for families making under $125,000 and expanding the income-based repayment program for student debt. Biden’s education proposals will increase funding by over $70 billion for Historically Black Colleges and Universities, Tribal Colleges and Universities, and other minority serving institutions. This proposed spending will provide financial support for those who traditionally may not have been able to pursue higher education, while also developing a highly trained middle class that has the skills needed to succeed in a modern economy.

Minimum Wage Increase

Wages for American workers have been stagnant for the past few decades. To begin to fix that, Biden will increase the federal minimum wage from $7.25 (established in 2009) to $15 per hour, and index it to the median hourly wage. This means that as the median wage in America increases, the minimum wage will increase lock-step. This will hold employers accountable for paying a living wage that keeps up with the growing American economy.

A report from the Washington Center for Equitable Growth shows that indexing to the median wage will help to close the wage gap and address economic inequality. Increasing the minimum wage in a way that is consistent but gradual, gives employers the ability to plan for wage increases and will have a lower impact on labor markets compared to large, sporadic minimum wage increases that have been done in the past. An increase in the minimum wage would also help remedy racial economic inequality in America; the EPI found that 40% of all Black employees and 34% of Hispanic employees would receive a pay increase if the federal minimum wage was raised.

➪ Research published by economists at Dartmouth and Michigan State about past minimum wage increases shows that there is very little evidence that a higher minimum wage would result in job losses. The economic benefits of working-class employees having more take home pay (to spend & save) would outweigh the potential strain on employers to pay higher wages.

PUTTING THE AMERICAN WORKER FIRST

Fair Trade

Over the past two decades, there has been a significant loss of manufacturing jobs in the United States. According to a report published by the Economic Policy Institute, “the United States lost 5 million manufacturing jobs between January 2000 and December 2014.” While it is easy to blame automation and advances in technology as the reasons for manufacturing job loss, the Economic Policy Institute cites growing trade deficits, especially with China as the primary culprit.

→ A trade deficit occurs when the U.S. imports more goods than it exports, and while there has been a trade deficit every year since 1974, the growing trade deficit with China has accelerated manufacturing job losses in the 2000s. In fact, the Economic Policy Institute found that 2.8 million American manufacturing jobs were lost between 2001 and 2018 due to the growing trade deficit with China.

To protect and increase American manufacturing jobs, the United States government needs to take decisive action to negotiate a fair-trade deal with China that protects American workers and companies.

According to his “Made in All of America” economic plan, Joe Biden will “take aggressive trade enforcement actions against China or any other country seeking to undercut American manufacturing through unfair practices, including currency manipulation, anti-competitive dumping, state-owned company abuses, or unfair subsidies.”

Job Creation & Protecting Workers’ Rights

Joe Biden is a fervent believer in the importance of unions and collective bargaining in protecting workers’ rights and the integrity of the middle class. Biden will create and reinstate policies that fortify workers unions, which stand up to corporations and fight for just compensation, benefits, and protections for workers. He will also create new protections for gig economy workers, following California’s lead to ensure that those working as full-time employees receive the paycheck and benefits that they are owed.

A component of Biden’s economic proposal includes using federal funds to truly “buy American”. Biden is proposing to implement a $400 billion Procurement Investment strategy, which means using federal funds to buy goods and services for the federal government from American companies. This also includes awarding more federal contracts to American companies. Under the Trump administration, government contracts awarded to foreign companies have gone up 30%. Biden will use American tax dollars to fund American businesses and create jobs here, not overseas. This policy will bring back and help build up critical supply chains in the United States and make the U.S. less reliant foreign production and investment.

Infrastructure & Clean Energy

Biden’s jobs plan includes a $300 billion investment in Research & Development activities over the next 4 years, in order to bolster new technological innovations and help transition American manufacturing to comply with heightened clean energy standards. His proposal would invest $50 billion to retool workforce education programs to make these programs more relevant and effective, so that they can help prepare American workers for a transitioning economy.

Courtesy of the Biden-Harris Campaign

➪ It is estimated that this plan will create over 3 million new, high-quality jobs, including 1 million in the auto industry.

Biden has proposed spending $2 trillion on his climate plan, which will focus on transitioning the American economy away from its reliance on fossil fuels and promote the adoption of clean energy solutions, while also creating sustainable high-quality jobs. Biden’s climate proposal also includes funding for needed infrastructure projects including bridges, high speed rail, greenways, and more community parks. Biden’s plan will issue low cost financing to small and medium sized manufacturing companies to ensure that they are able to keep up with changing environmental standards.

TAX REFORM

Tax reform is just one piece to Biden’s plan to Build Back Better, but it is the piece that will wind up affecting each one of us the most directly.

→ So how will Joe Biden’s tax plan impact your 1040 (aka your tax refund)? His plan is two pronged: reinstate fair tax rates for corporations and individuals in the highest tax bracket and beef up tax credits for all Americans.

Don’t worry - no one earning less than $400,000 a year will see an increase in their tax bill - and those that do will only see the tax rate on income above $400,000 reinstated to pre-2017 levels (37% to 39.6% on dollars earned over $400,000). Biden has also proposed to increase the corporate tax rate from 21% to 28% and work to close tax loopholes that have allowed Amazon to pay less in taxes than you do for your Amazon Prime subscription. Large corporations rely on the government for the same things that ordinary Americans do - for infrastructure, an educated workforce, and public safety, and Biden’s tax reforms will ensure that they are paying their fair share.

Tax Credits

Let’s talk about tax credits. Tax credits reduce tax liability directly, one for one. If you owe $2,000 in taxes, but you have a $2,000 tax credit, it is offset and you owe zero. Tax credits can be used to provide more equitable benefits for taxpayers in the lower marginal income tax brackets. They can also be used to implement social objectives. Biden’s proposal uses this financial incentive to promote first time home ownership, affordable child care, clean energy, and affordable housing. His tax credit proposals are outlined below:

First Time Homeowners

Revives and enhances the Great Recession era tax credit of $15,000, not to exceed 10% of the price of the home. Plus, this tax credit can be used at the time of purchase.

Affordable Child Care

Increases the Child Tax Credit, increases the Child and Dependent Care Credit, creates a new tax credit for employers who build onsite childcare facilities, and creates a new credit for informal caregivers.

Clean Energy

Creates tax credits for energy efficiency in homes and businesses. Also creates tax credits for electric vehicle manufacturing and solar energy investments.

Affordable Housing

Expands the Low-Income Housing Credit, caps rent and utilities at 30% of income, and creates a tax credit to promote investment in manufacturing and low-income communities.

CORONAVIRUS RECOVERY

Joe Biden has acknowledged the failure of the current administration in developing a strategy to help Americans tackle the coronavirus pandemic and provide a path to recovery. The second quarter of 2020 saw the largest drop in the U.S. GDP since it began being reported at 9.1% – which is 3 times greater than the record GDP decrease that was caused by the Great Recession. The unemployment rate is holding steady around 8.4%, proving that the U.S. economy is not experiencing the V shaped recovery the Trump administration has promised.

Biden knows the stock market is not indicative of the economy, and that we still need to provide immediate assistance to workers while creating policies which insulate America from another economic disaster that inevitably the next pandemic will bring.

Joe Biden’s economic policy on the coronavirus is that the federal government must step in to get the U.S. to the other side of this pandemic. This includes spending on testing, contact tracing, and developing and administering a vaccine. He will make sure that no American has to pay out of pocket for these measures and believes that they are all vital steps towards eradicating the virus.

Biden also plans to expand unemployment insurance to include independent contractors and non-traditional workers who can show that their hours have been reduced because of the pandemic. He will ensure that employers adopt an emergency sick leave policy that allows employees to take up to 14 paid sick days for themselves or to care for loved ones. The policy will reimburse weekly wages up to $1400 to ensure employers are able to implement this sick leave. Biden will expand SNAP benefits, give support to local food banks, and ensure that children that rely on free and reduced lunch are still fed, even if schools remain closed. His proposal ensures that the federal student loan forbearance does not end on December 31st, but rather that it is extended until the end of this national state of emergency.

Joe Biden vows to create a State and Local Emergency Fund to give local leaders additional resources to help those struggling. This fund will allocate 45% to state governments, 45% to local governments, and reserve 10% for local hot-spot areas.

State and local governments are responsible for funding things like public schools, including teachers’ salaries and community protection services such as police and fire departments. This emergency fund can also be used for mortgage and rental relief, payroll assistance for employers, and interest free loans for small businesses. Biden’s proposal will also provide federal assistance to state unemployment offices to assist them to manage higher demand and requests. Biden will work with local governments to provide relief to those with federally backed mortgages and reinstate the eviction moratorium for the duration of the pandemic.